Update 1/11/2024:

The specific practice loan that I referenced as giving rise to this post began earlier in 2023, and this post was months in finalizing. I’d originally intended to publish it in the summer. Since publishing, I’ve since learned that RP’s extra support has briefly paused.

That’s right, at least for a month or two, the group’s compensation reached the threshold that turned off the “advance” from RP. Hospital subsidies saved the day. Note that the loan term itself isn’t over, and after briefly not needing it, the group has since required more gravy.

Ultimately, this suggests that RP may have chosen the loan method for supporting this practice because they had specific reasons to (correctly?) believe that the loan period would be time-limited: It’s obviously better to give some money temporarily in a non-binding fashion to save a group in crisis than to permanently change the contract if you don’t have to.

The real question for the future will be: will the group consistently earn enough in the end to pay back several million dollars of borrowed money, and if so, how long does that take? And/or, does the group fight it? It sounds like what seemed like free money at the time may ultimately be an actual loan, and paying back that advance will therefore constrain compensation going forward unless long-term profits stay below the mark due to increased contractor use, the need to sweeten up internal moonlighting rates, or understaffing requires dropping volumes. Any or all of those things may happen. They are things happening at groups of all stripes across the country.

The future remains uncertain as always–and RP may still never recoup this loan–but this also means that I was wrong in how easily I dismissed the likelihood of RP seeing some of this money back.

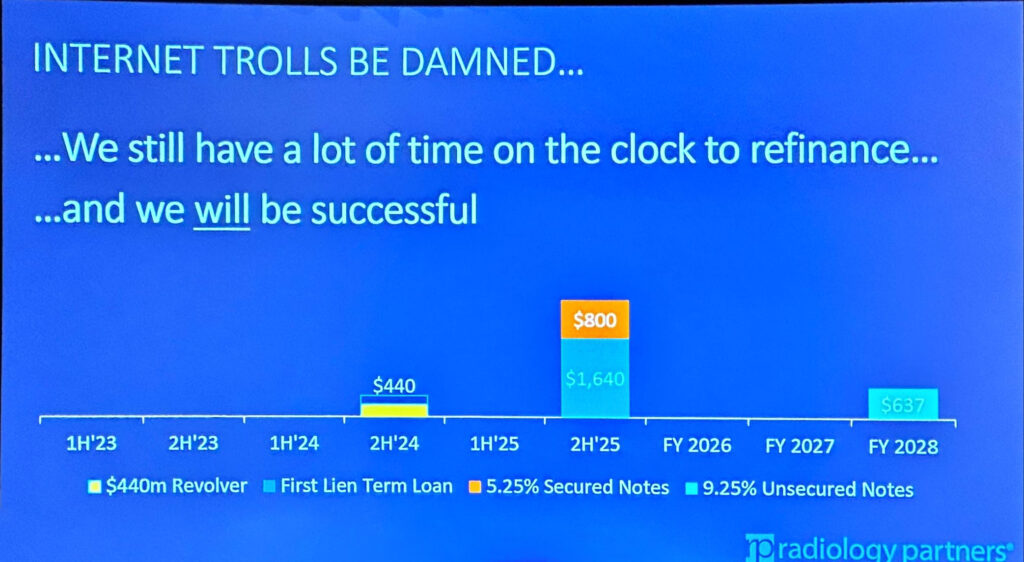

This month credit agency Moody’s downgraded Radiology Partners again (surprising exactly no one): the first (and smallest) of its large debt obligations is due in 2024, they currently owe 10x their earnings, and they can only service these debt obligations through refinancing, which is challenging in the current market even before you consider the potentially tenous state of RP’s acquired practices when they reach their 5-year vesting window. It was inevitable.

If you ask RP, they will tell you that all third parties–whether Moody’s or just a random internet troll like myself–don’t understand their business and aren’t privy to the magic happening behind the scenes.

They consistently maintain that they will be able to refinance, though they never publically acknowledge that the most likely refinancing they will achieve is some form of distressed exchange like a debt-to-equity swap that would likely dilute current shareholders (and is considered a bankruptcy equivalent).

Here’s a slide from their big meeting earlier this year:

I know some people in the radiology community think that when the debts come due that RP will go bankrupt and disappear, but that’s simply not going to happen. Depending on how broadly one defines “success,” there’s an excellent chance they’ll be successful. (To wit, Envision emerged from bankruptcy in the hands of its creditors, but it didn’t go anywhere.)

But here is something you haven’t seen in the news but is nonetheless interesting:

Radiology Partners—already dealing with recurrent credit downgrades, cashflow problems, and investor fears—has been offering no-interest loans to some of its practices to shore up compensation.

Note: I’ve heard a similar story independently from several RP radiologists, but I do not know how common the offer has been (I suspect not very). For what it’s worth, I did reach out to RP and Melinda Collins (AVP of Marketing and Communications) on Twitter/X last week without a response. If you’re at RP and want to weigh in on this purported practice, please reach out. If I’m wrong or misleading in any way, I really, really want to know.

To my knowledge, nobody has pressed RP on this issue yet, and it has not been discussed in any public forum other than a brief mention on this site earlier this year in a quotation from a former RP radiologist. Since that time, I heard from multiple sources that at least one practice has taken the offer, hence this post.

So how does this look in practice? Let’s discuss.

So what do you do when people want more money to work, but you’d prefer not to pay them more? What do you do when you simply have to put more money in someone’s bank account?

Well, it turns out that one of RP’s solutions, at least recently and in some situations, has been to offer no-interest loans to practices. I know for a fact that RP is not offering this to all practices that want more money, and I have no idea what criteria they use to determine how they negotiate with each purchased practice that is struggling and/or threatening. I don’t know how many offers have been made, how many have been accepted, or how much they differ.

But at least one gist apparently worked something like this: A practice gets a loan with extra money for each employee and a different amount of extra money for each partner to lift them to a certain income threshold as long as the practice meets specific metrics with regard to productivity and overhead/cost mitigation. So, for example, as long as the practice is putting up 75 RVUs/day on average, then they get the extra money. At least in one case, this was reportedly offered for up to two years without interest until revenues were high enough not to need it.

When is that loan paid back? I’m told the plan is that the loan is paid back only when/if the organic revenues of the practice exceed the current inflated income with the loan in place. At that point, the extra income will be used to pay back the loan. As in, the practice will only begin repaying the loan when it earns enough money without the loan to exceed the propped-up compensation enabled by that loan. (As in, if you were making $500k, and now you’re making $600k thanks to a loan, the practice would only start paying back the loan when the organic compensation itself was more than $600k.)

You might ask yourself: how would these struggling practices ever make that much extra money if they needed a loan in the first place to be competitive? And that is an excellent question. There’s no reason to suspect that they would be able to without some truly impressive subsidies (though RP has also been very aggressive in extracting subsidies) or (less likely) very successful recruitment thanks to stronger job offers.

Why A Loan?

You then might ask yourself: why would Radiology Partners want to loan this money given the very likely scenario that said money will never come back? What is the magical benefit of calling this salary support a loan instead of just paying people more money?

I don’t have an official answer for that.

One possibility, however, is what’s called window dressing.

You see, when a lender gives out a loan, it’s considered an asset and not a liability on the lender’s balance sheet. Yes, you’re giving the money away, but in theory, you will receive payments back in the future (typically with interest). Banks make money by loaning money.

But if the reality is that these loans will likely never be repaid? Giving a practice more money is just an expense. Loaning that practice the same money–if it’s not coming back–artificially makes the business look healthier than it really is. It takes an expense and pretends it’s an asset.

The reality in the current job market is that RP has to pay some of its rads more, particularly those legacy partners they essentially bought for 5 years until everything vested. Calling it a loan may make things look peachy in the short term, but spending more on labor–regardless of what you call it–is an additional constraint on RP’s cash flow and profits.

It’s important to note that I am not suggesting this tactic is really nefarious. RP may have reason to believe they’ll recoup at least a fraction of the money. But regardless, a little bit of turd polishing is to be expected. One of the problems with the finance industry is the extent to which proxy financial metrics can be manipulated to tell whatever story you want. As the recently deceased Charlie Munger said, “Every time you hear EBITDA, just substitute it with ‘bullshit’.” I would suspect anyone reviewing the books and doing their job should notice the maneuver.

Lastly, one psychological factor at play is loss aversion: the concept that a real or potential loss is more emotionally powerful than an equivalent gain. So, instead of saying you’ll give a big bonus if your rads hit a certain productivity metric, you give the big bonus upfront and say you’ll take it away if they don’t meet the metric.

What does this mean for individual radiologists?

Well, I’ve argued in the past that anyone looking at a corporate job should really be looking at the current compensation and not the future promises of increased compensation. Again, the partnership is in name only, and anything can happen.

But I would argue now there should be an additional grain of salt: anyone looking to work for RP should also ask any practice if they’ve taken a zero-interest loan, because these loans are contingent on practice metrics and also contingent, presumably, on RP’s ability to be generous enough to continue paying them.

A loan structure like this provides a floor for compensation, but it also creates a ceiling if the “excess” money you earn goes to loan repayment.

Part of me also wonders if there is any chance the “partners” are somehow otherwise on the hook for these loans in some way as a form of golden handcuffs. As in, perhaps there are no real plans to demand repayment except if the practice were to fail on some key metrics, at which point RP starts trying to claw its money back. I actually imagine that this is not the case, as that would seem far too risky even for desperate radiologists at a practice taking a loan, but it was actually the first question that an RP radiologist at a practice that hasn’t been offered a loan asked me when we discussed it. (I suppose the counterargument is that this could be an additional extraction step from legacy partners to squeeze some late money out of the sale before departing. Details matter, and I don’t have them.)

So, just look very closely at how your compensation is described in your contract. For select radiologists, it’s theoretically possible some of that nice competitive compensation could evaporate when RP’s line of credit becomes due next year.

But if one has to guess, regular employees are probably at no risk here unless there is a strict productivity component for your base compensation. I have no idea how your compensation is described in the contract, so you just need to read it carefully. The “partners” may be the ones who start losing if the group can’t meet its metrics or RP runs low on cash.

When RP says that external entities don’t understand their inner workings, they’re right. I certainly don’t. This is just food for thought. Doing your due diligence isn’t going to hurt anyone.

What does this mean for groups?

No independent practice I’ve ever heard of would consider taking on millions of dollars of debt to prop up compensation in the short term, but that is functionally what RP is able to do (given their current heavy leverage) in order to remain competitive in the tight job market and stave off the exodus of partners no longer shackled from the sale of their practices.

But RP may not mind, in the short term, paying some of their rads millions of dollars more as those buyouts mature, at least for those practices that are the most profitable or most strategic. For one thing, they’re turning the screws on many of their contracts to renegotiate compensation and get stipends, so I’m sure the goal here is a temporary measure to at least break even on the increased compensation in the long term. (And no, that’s not a knock on RP. Every group is trying to get paid more right now; that’s the law of supply and demand at work.)

But overall, operational expenses are dwarfed by their large debt portfolio, and when/if they can restructure, the company presumably hopes to survive in some way and have most of its debt wiped out. These loans aren’t going to change that timetable or be big enough to move the larger needle, so if it’s going to happen anyway, keeping these groups afloat is better than the alternative of having all these practices implode and having no business at all. You can’t sell equity in a business that doesn’t exist, and this allows them to continue shopping around a big business with lots of top-line revenue growth.

So for the groups that have received this offer (and I don’t know how many have), I can’t say I blame any for taking a zero-interest loan from RP to make more money. While the stock you own in RP may become worthless, it’s probably a good bet to take more cash in hand right now than to worry about the potentially valueless stake you have in the company.

And the future?

But again, for the younger radiologists, if you’re trying to start a career somewhere hoping to have a long-term stable income and be happy where you work, the question is a lot more complicated. I don’t know what will happen to compensation across the radiology job market (let alone just at RP) as the situation evolves over the coming years. I really, really don’t. I’m not sure anyone does.

The whole market is in rapid flux right now: there’s a lot of job churn out in general, and teleradiology positions currently provide an “out” from a toxic local job to wait out a non-compete. I do think it’s a little harder to view a group’s long-term prospects as stable when its corporate owner is headed toward bankruptcy and it’s extending loans to doctors–even fake pseudo-loans–in order to make compensation competitive.

This may be a good tactical play for the next few months to prevent operational insolvency as they try to refinance their debt. I suspect even with this kind of offer on the table, there will be groups that may end up dissolving or shrinking considerably over the coming years. The secondary question is what happens to those rads waiting out their non-competes: Teleradiology forever? Hospital or other corporate employment? Re-form a new independent group? I know a lot of people are hoping for the latter, even if the alternatives of working directly for the hospital or another corporate entity are probably more likely in many markets.

Lastly

Details are sparse, and RP’s story is evolving as we approach its first big debt deadline. Also, I’m obviously biased.

For what it’s worth, I really don’t think this practice is ubiquitous in RP’s portfolio. After all, they do have other ways to pay rads more that probably also make sense in some settings: they can adjust the group’s RVU factor or offer to convert compensation from percentage of collections to flat salary/employee style.

Please don’t leave this with the impression that I think I know what’s going to happen next.

10 Comments

Thanks for getting the word out about this. These loans to increase compensation are another consideration for potential applicants looking at a “psuedo-partnership” track job with RP. This is another hidden factor which decreases potential future upside of a “psuedo-partnership” private equity job, which RP purposely tries to keep hidden. Applicants are told if the practice does do better down the line then “partners” can be getting a certain percentage of profits as bonuses. But with these loans, even if a practice does do well in the future they are paying back loans to RP instead of getting bonuses.

There are way more radiologist openings than supply of radiologists needing jobs. Young docs should avoid these PE groups like the plague. We should force bankruptcy on the corporations. They are nothing but leaches. Private groups should also avoid hiring radiologists that have a history of selling out their profession. These docs should be forever shunned for their treachery.

I left RP after my 5 year “vesting period”. A lot of my partners left but a lot stayed because of “better compensation.” Of course they upped the RVU requirement. They won’t buy out my “shares” which I regarded as worthless anyway but it would have been nice to get something, even pennies on the dollar.

RP: Heads, I win. Tails, I do not lose.

I love how all this nitpicking is predicated on the “big debt load” but without any real input from investors who’re actively refinancing this as we speak. Biased indeed.

I actually don’t think that particular skepticism is actually my bias at all.

I have actually spoken with multiple investors and others on the debt side of finance who have been very dubious. The credit agencies are admittedly conservative but have repeatedly revised their outlook negatively. And multiple companies in the industry have struggled and several have gone bankrupt.

If RP refinances as you say, that outcome would make a lot of people’s predictions wrong, but it doesn’t mean they (or I) were all “biased” to have made them. You can’t only judge the quality of an argument or a decision by the outcome, one has to consider–at the very least–the available information and the role of chance.

My bias is that I think the PE funding model has been problematic in general and is poorly suited to healthcare. And I also have a conflict of interest in that I am a young radiologist in private practice, and so even though RP is not meaningfully in my local market, they do impact the broader field of radiology and the job market in general.

So if RP is entering the lending business…do you know how this would affect rads that have partnered with RP if they end up filung for bankruptcy protection?

It is my understanding when I company files for bankruptcy protection equity shareholders are one of the last people in line for $. Secured creditors with collateral are first, them all these bondholders, then preferred stock holders, then common. I imagine rads that are ‘owners’ own common or even preferred stock. If they file for bankruptcy every cent would get used up before the bondholders are paid and the rads would get $0. If my understanding is correct.

The lending thing, such that it is, is basically irrelevant. RP’s capital structure in general though is highly relevant.

Yes, if RP were to file for bankruptcy, the equity will likely be wiped to zero. The odds of anyone getting anything are pretty low, but it’s theoretically possible that some preferred share classes could get something.

That is presumably one big reason why RP is trying very hard to refinance instead of going bankrupt. They would also likely prefer to trade debt for equity even in a way that would dilute current shareholders because even diluted equity is still worth more than nothing.

Thank you for sharing this informative article.