You need at least one Employment Certification Form per employer for PSLF. A good rule of thumb is to submit annually to help make sure that FedLoan is counting your eligible payments correctly, and it’s a perfectly good idea to submit your first ECF a few months into a new job.

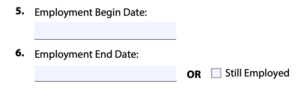

But, as you can see on the form, its purpose is to describe a period of qualifying employment that has already occurred and that FedLoan can thus use to mark each payment you made during the same period as eligible for and counting toward the 120 needed for PSLF.

As such, you need not try to submit a form the second you start a new eligible job such as your intern year. I’m looking at you, interns in July. You totally can, but it’s sorta meaningless outside of initiating the transfer to FedLoans if they’re not already servicing your loans. The main exception is if you’ve taken a job that you’re not sure qualifies and you want some official guidance before you keep working there. In which case, sure, fire away. In general, it makes sense to submit your first ECF after making a few months of qualifying payments.

Note that switching servicers can sometimes make other bureaucratic things like switching repayment plans complicated, so it’s advisable not to submit your first ECF near when your income recertification is due. Wait until that’s fully processed first. So, if you entered repayment in June or July and want to make sure things are moving in the right direction, then you could file an ECF sometime in the fall if you’re eager for some news.

You should absolutely submit your ECFs annually, but you should at the very least submit one at end of your tenure with each institution. You don’t want to be trying to get old employers to fill out things retrospectively or to have FedLoan reach back into the distant past to try to count up your payments for the first time. Experience has shown that counting is not really their strong suit.