After my rant last week that radiology software companies need to spend the resources to actually involve radiologists in product creation, I got a great email from a large company who loved the article, asking if I could review their roadmap because they would “appreciate” my “perspective and feedback on where we are heading.” They missed (or pretended to miss) the point: You may think you need a free hour of a radiologist’s time, but you’re wrong. You need a thoughtful radiologist who cares about your product to be consistently involved.

Michael Crichton (famous novelist and never-practicing MD), describing the cognitive bias of “Gell-Mann Amnesia” in a 2002 speech (as included in How Not to Invest by Barry Ritholtz):

You open the newspaper to an article on some subject you know well. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the wet streets cause rain stories. Papers are full of them.

In any case, you read with exasperation or amusement the multiple errors in a story—and then turn the page to national or international affairs, and read with renewed interest as if the rest of the newspaper was somehow more accurate about far-off Palestine than it was about the story you just read. You turn the page, and forget what you know.

One of the points Crichton is making, particularly with regard to the media, is that we are more forgiving of certain institutions than we are with people in real life. When someone opines confidently but incorrectly about your area of expertise, you know they’re a blowhard. But we are generally forgiving of institutions (until we become so blinded by bullshit that we discount everything, adrift on a sea of conspiracy theories).

We do discount what are considered credible and trustworthy sources when we know they’re wrong but otherwise assume they’re generally right. It’s almost an institutional halo effect; we give more credit than due unless we are forced by our own knowledge to confront it.

In reality, the lesson is: truth is hard. People are wrong all the time, and institutions are full of people. That doesn’t mean they don’t matter—they do!—or that everyone is consistently wrong or that you should never trust anyone, but it does mean that our beloved institutions require maintenance and care.

Ritholtz:

There are tremendous advantages in recognizing what you do not know. Acknowledging shortcomings in your informational intelligence is a form of situational awareness that prevents you from being blindsided. There are other benefits as well. It shifts your focus to process over outcome; you can better understand what results come from skill versus dumb luck. It prevents you from being fooled by randomness.

We should be a little more thoughtful and a little less credulous. A little less precious with our own knowledge, acknowledging the shortcomings in what we know, where we seek information, and how we incorporate it into our latticework of mental models.

In other words: Less Certainty, More Inquiry.

“Shame is a dream killer” and 64 other helpful short notes from Seth Godin.

Regarding the nature of a “good job” vs/and/or a good career, the two different types of ancient Greek “happiness” as relayed by Arthur C. Brooks in From Strength to Strength:

Hedonia is about feeling good; eudaimonia is about living a purpose-filled life. In truth, we need both. Hedonia without eudaimonia devolves into empty pleasure; eudaimonia without hedonia can become dry.

A few more of my favorite passages from that book that work well together:

Hold your success lightly—be ready to change as your abilities change. Even if your worldly prestige falls, lean into the changes.

If you base your sense of self-worth on success, you tend to go from victory to victory to avoid feeling awful…You need constant success hits just not to feel like a failure.

Satisfaction comes not from chasing bigger and bigger things, but paying attention to smaller and smaller things.

This isn’t earth-shattering stuff, but I do think it’s a tidy illustration of how a small, easy-to-make change with a relatively minimal amount of hassle can nonetheless reap a small but measurable benefit—and in the long term, meaningful time and energy savings.

I appreciate/hope that this will all be irrelevant for radiologists very soon, but while thousands of us are still using Powerscribe, this is still part of our worklife.

Read More →

A few weeks ago, I got to enjoy a pitch for another poorly conceived “revolutionary” radiology AI workflow and reporting tool.

Tech people: Just bring on a radiologist CMO and a couple more to work on product. Stop cheaping out. Give them stock if you can’t pay, but these mostly suck and will continue to suck.

Everyone is happy to have some radiologists as “partners” that are just customers beta testing your buggy, half-baked products for free, but not enough are using content experts to make useful software from the get-go using first principles rooted in real-world experience and expertise. I would also love to see less focus on peddling trash and more on building product.

Free advice: Maybe just build something straightforward using current capabilities that is easy to deploy integrate into current workflows that people want right now. Something that doesn’t require massive buy-in and changing your whole tech stack.

Enterprise software sucks. Build up some good will, go from there. Not everyone needs to raise a ton of money to milk the bubble of me-too “AI for X” wrappers. Make something that solves a small, specific, real pain point and enjoy a nice cash-flowing business for a few years.

Reinvest in the next product if you want—or don’t. Forget about multiple rounds of raising capital trying to build and scale a behemoth on a foundation of sand.

Now, if you really want to revolutionize everything and replace radiologists with magical AI powers, great, that’s totally fine. You may be able to skip lots of radiologist feedback (though I imagine you’d still be better off with some deeply integrated, thoughtful radiologists). Someone somewhere can revolutionize everything from farm to table, but there’s also low-hanging fruit to optimize specific parts of the workflow in the meantime. Every part of the imaging pipeline has tedious, essentially broken software tasks and inefficiencies, and in many situations, it’ll be easier to optimize them individually in the short term than try to replace everything wholesale.

In other news, if you’re a current software vendor, now is the time to improve your offerings before it’s too late.

Everyone is happy to play the enterprise software game and court big hospital systems. But no one wants to build a grassroots business working with real people doing real work—because it doesn’t scale easily and it’s hard to raise money for.

I know that getting customers is hard—but that may be because your product sucks, because of the friction involved in transitioning to an unproven solution, or because you can’t demonstrate real benefits beyond just saying “AI.”

Yes, inertia is real: your new thing needs to be way better than the incumbent or something you can plug in for a reasonable additional cost. That still leaves a lot of opportunity on the table.

Private equity radiology company US Radiology Specialists (USRS) is changing its name to Lumexa Imaging. Lumexa sounds like prescription eye drops or a new antidepressant. Or maybe an overseas manufacturer for flashlights on Amazon.

Morgan Housel, “Little Ways the World Works”:

Chamath Palihapitiya once noted that however fast your business grows, that’s the half-life for how quickly it can be destroyed. So many companies, flush with cheap money from previous years, are learning this right now. Every business and every industry has a natural growth rate – push beyond it and short-term growth comes at the cost of long-term quality, and eventually survival.

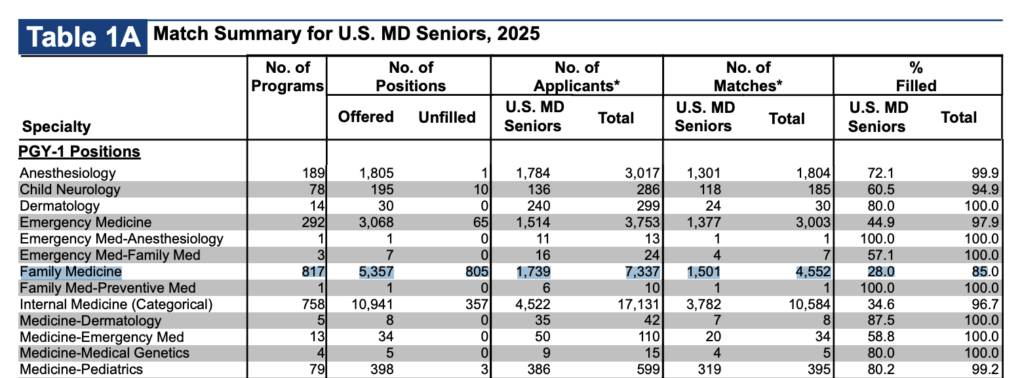

Another year of the NRMP match results, and Family Medicine continues to be a relentless slow-moving disaster within the house of medicine. 805 unfilled postions, only 28% filled by US MDs. Just 1,501 US MDs in the whole country matched to one of the most critical jobs in all of healthcare (1739 applied, but the discrepency is probably a reflection of FM being a back up option for several hundred people).

I think people see this and point out several obvious deficiencies:

- Pay

- Prestige/respect

- Midlevels

All true. All essentially impossible to easily fix within medicine and our training paradigms. Some people discuss the possiblity of special loan reimbursement, and that I suppose is obliquely helpful, but the reality is that PSLF already exists and there are already programs for working in underserved areas. Debt is a problem, but I don’t think tackling that head-on is going to solve the decline of primary care in the US.

Another suggested solution I often hear is to make family medicine sexier by allowing for different fellowships, creating more training options and allowing family docs to broaden their skills into things like dermatology.

There may be something to this, though I suspect in most cases, there probably isn’t. Even if such broadening were successful, it is probably counterproductive to the actual goals of primary care. A backdoor into dermatology is probably not going to solve a shortage of qualified practitioners. Nor do I think additional training is going to improve perceptions of prestige or respect.

The thing the ACGME can do to make things better are to change the training composition/requirements and especially length. Family Medicine should probably be a shorter, outpatient-focused course of training for general practitioners in the US.

In the era of massive midlevel expansion, it simply can’t be three years long. Anything else isn’t going to work to get people interested again.

In a world where many institutions struggle to attract aspiring family practitioners, I suspect the only solution is to fight fire with fire. I think we need more efficient training. We need to acknowledge that while more training is always good, it isn’t always necessary. And if we can’t get the job done in less time (though Canada is two years), then we need to seriously consider the efficiency of our process and the ability of our tools to assess competence.

We have, for too long, resorted to a proxy metric of time to tell us that somebody is skilled. This crude tool shouldn’t be the best we can hope for going forward. Nor will it help us address a possible post-AI world where physician retraining may become a more pressing concern.

So, I think the answer is just to start by shaving off a year and getting it done in two years.

(In a fantasy world, training duration would be as long as it needs to be. Strict training lengths are important to hospitals using residents for predictable labor, not because every doctor needs the exact same amount of training time to reach competency. The ebb and flow of patients in a resident clinic is probably slightly easier to accommodate than hospital service coverage.)

Given the current reality that many people in family medicine do not want to practice a significant amount of inpatient medicine, potentially refocusing a portion of that to an optional third year instead of making it a core part of the residency is likely one way to offer flexibility without fundamentally changing the field. Offering different paths for those who want to work in rural areas doing procedures and those who want to do OB are great ideas, but some serious introspection to figure out what the core of a PCP/GP should be in the US is overdue. I won’t claim to know the answer, but the match results tell us some stakeholders need to figure it out.

I also want to preempt anyone who wants to argue that doctors are already poorly trained and that shortening training will worsen that problem. The answer is, of course, all things being equal, that shorter training will be worse training. Many older physicians indeed believe that younger physicians are graduating “less well-trained” than previous generations. Part of that is a manifestation of reduced training volume. Part of it may be related to the increasing complexity of medicine. And part of it may be related to cultural shifts, such as decreased studying after work, and other such factors.

But that assumption also implies that there is no fat to trim, that all months of training are essentially equally useful, and that a shorter process should look the same as the longer process, just worse. All training is useful, but some is clearly necessary. The reality is that we cannot afford to ignore training quality. We need to provide better, more effective training. We need better measures. We need to reward hard work and variable skill so that the most competent people can graduate when they’re ready and not just when they’re older.

And ultimately, we need to rethink our fixation on time as the defining measure of competency. It’s not. It’s a crutch.

It’s job-hunting season, and I’ve received a variation of the following question several times this week alone: “How do I figure out if a practice I interview at might sell to private equity?”

I appreciate the fear of joining a private practice only to have the rug pulled during the workup in a sale to private equity. It’s what I was worried about when looking for jobs in 2017, what I was scared of when I entered practice in 2018, and what happened to some of my friends in 2018-2019.

My group was and is fiercely independent, and I was fortunate that the Dallas area was not ripe pickings for Radiology Partners, unlike Houston and Austin markets. But I had many of my friends end up on the wrong end of a sale and eventually change practices.

I have also certainly spilled enough digital ink on this topic over the years myself, so I am probably not entirely free from blame for increasing the collective anxiety about this issue.

But I do think that at this juncture, it’s relatively low risk.

The era of PE expansion in radiology through debt-fueled acquisitions of individual practices is essentially over, as far as I can tell. This is a model almost entirely dependent on the zero interest rate environment of the twenty-teens. The costs of borrowing money now are too high to enable these shenanigans, and the degree of leverage these companies have is already so high that there really isn’t any excess capital to deploy in acquiring individual practices when they also need to service their debt, pay for operations, and invest in AI and other magic.

Furthermore, the PR is not great at this point, and I doubt most practices that are actually healthy would want to sell. No one is buying the initial magic & sparkles pitches, so I don’t think either party wins in 2025, and everyone knows it. A struggling practice wanting to hitch their ride to a larger organization and/or extract some value before implosion would be a different story—but those would be less desirable for a purchase. RP, USRS, and LucidHealth may not be that good at actually running a radiology business, but they are very good at their real business, which is a primarily finance game that happens to involve healthcare.

So, investing tens of millions of dollars (even if you had them to burn) in an individual practice acquisition is very risky in 2025. Since these companies have reached scale, there are better ways for them to grow.

Private equity is more likely to grow their workforce through hiring individual radiologists than they are through group purchases, and they’re more likely to grow their imaging volume through organic growth or contract sniping than they are through the outright purchase of a practice. They can also grow by picking up the pieces when someone else fails, like RP did when Envision “transitioned” the corpse of its radiology business.

The “hostile takeover” is still somewhat possible, in the sense that an RP or similar could swoop in and try to steal a contract from a local group, have that local group dissolve because that contract represented a large fraction of their business, and then hope to hire up some of those radiologists for free on the back end to essentially keep the jobs they already had but have since lost (as in, keep staffing the hospitals they were already staffing before the contract change).

This has happened before, but even this, I think, is relatively unlikely to happen now or happen at scale, because these PE companies are not immune from the challenges in the market and have a hard time staffing as well (and also because many hospitals aren’t particularly happy with their level of service).

The reality is that private equity hasn’t gone away and won’t go away, but the greater fear for an individual practice is to implode under the weight of unsustainable image volume growth or be unable to provide the right lifestyle and compensation balance that are required to hire and retain radiologists in this increasingly nationwide market in the era of teleradiology.

A group failing because they can’t be competitive in the job market because their hospital won’t pay for the stipends to make their job competitive, for example, is a real concern. Could a PE-entity swoop in and hoover up some work there? Absolutely, but that’s not the same thing as your new practice screwing you over.

This is to say: If the job sounds good enough that you want to do it, then I personally wouldn’t worry much about it at this point. A healthy group probably doesn’t have much to fear from private equity in the short term given the radiologist shortage. The market itself is enough of a challenge.