The battle between Radiology Partners and UnitedHealthcare has ended with United as the victor.

The summary:

- RP claimed United owed them lots of money for underpayment because United was using a 2020 contract to determine some of its payments instead of a more lucrative 1998 contract originally held by one of its purchased groups, Singleton.

- United then sued Radiology Partners alleging an illegal pass-through billing scheme. It’s a good read.

- The arbitration panel awarded RP an interim award of $153 million. This was very much interim, not just because the independent panel had awkward bias conflicts, but also because the panel decided to separate the question of whether Singleton’s lucrative contract was in effect (it was) and if RP was abusing it (which it was) into separate steps.

The $153 million award would really have only been an extra $94 million since United had already paid for the work at a lower rate. (Author’s note: That’s quite the contract.)

Phase III—that awkward fraud question—just finished. The ultimate findings of the panel (free login required):

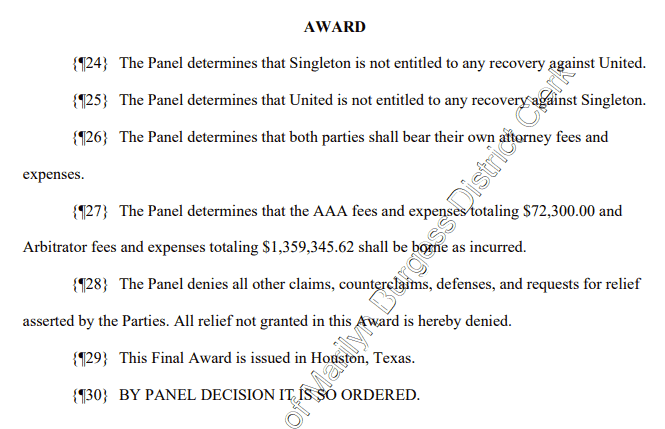

In the Phase I Decision entered on April 2, 2023, the Panel made the following finding: “The Panel finds the 1998 contract to be the operative agreement between the parties.” The Panel confirms this finding.

In Phase II the Panel entered the Interim Award On Singleton’s Arbitration Demand on September 26, 2023. The Panel now vacates that Interim Award.

The difference between the amount United paid on claims pursuant to the rates specified in the 2020 Agreement and the amount it would have paid pursuant to the rates specified in the 1998 Agreement is $94,275,324.00. United’s underpayment of Singleton’s claims at the rate specified in the 2020 Agreement was a breach of the 1998 Agreement.

Because of its breaches of the 1998 Agreement and its other acts and omissions, Singleton is not entitled to recover this difference and underpayment or any other relief against United. Because of its breaches of the 1998 Agreement and its other acts and omissions, United is not entitled to any other relief against Singleton. The Panel determines that the evidence fully supports these decisions at law and in equity.

Translation: you are both jerks, you are both wrong in your typical unique and despicable ways, please go away forever:

United was wrong to unilaterally use the incorrect contract to determine payments. RP was wrong to hide its ownership and then essentially pretend that every group in the region it owns was Singleton when they clearly weren’t.

(For more description/backstory, see the previous two posts: United against Radiology Partners & United is Still Fighting Radiology Partners.)

For those keeping score at home, United’s lawyer was correct when they said, “We do not agree that Singleton will recover an award from UnitedHealthcare.”

In other news, whether or not they were right, United is still a terrible company.

8 Comments

Since RP is owed the $ at 1998 rates, why did the panel vacate the award? Even if what they did was shady, it still was technically enforceable?

The first post in the series describes the issues in more detail. But essentially the panel zeroed that extra money due because RP violated multiple terms in that contract. To summarize in one sentence: pass-through billing is illegal, and RP funneling all of its work in the region through “Singleton” even though Singleton and all the other groups those rads work for are all still technically individual companies with their own Tax IDs is more than shady.

*In other news, whether or not they were right, United and RadPartners are still a terrible companies.*

Fixed it for you.

Greed is greed! As R. G. Lee once preached, “Payday, Someday“! Not every selfish act gets immediate attention and judgment but ultimately, each will!

I once owned several imaging centers and for a few years (during the downturned economy around 2008-12), I was in financial trouble. I was offered what would amount to pass through billing by a nearby rural hospital (which would have doubled or tripled my net per MRI). Although the offer was LEGAL, it was deceptive to an unaware patient or referring physician so I rejected the lucrative offer. Despite a distaste for UHC, etc, isn’t it easy to see that RP KNEW what they were doing was inherently deceptive and therefore should have been avoided?

(BTW, I survived the financial disaster!)

I do not believe most of the individual radiologists or groups had any idea. I’m not even confident the radiologists employed by the group with the best contract used for the scheme were aware of the extent of what was going on, and I’m not sure that MBB in the Aetna case was even aware that they had been dropped by the payor and were now out of network.

I’m not privy to the inner workings of RP, but I have talked with people who were formally with the company. And yes, I believe they were fully aware of what was going on, and that this kind of out-of-bounds financial arbitrage was just part of their business plan and the risk of getting caught a cost of doing business. For example, the original RP leadership team came from DaVita. DaVita has paid over $1 billion in fines for various unethical and illegal business practices including many for violating anti-kickback rules, paid referrals, etc, which everybody knows is illegal–they just don’t care. They presumably think it’s worth taking the risk in order to grow the business and make money right now. They probably only get caught a fraction of the time.

Ultimately if we allow the business folks to have a short time horizon, such that the benefits of strong quarterly or annual performance have an outsize impact on compensation, we will continue to see this kind of behavior. Given that many of these funds want to flip the business and sell it in 4 to 7 years it makes sense that they may take on risks that make the business look good in the short term and hope to dump it on someone else before the cards fall.