Last week, Radiology Partners released an announcement that it was “commencing a comprehensive set of financing transactions to strengthen its financial position.”

Setting the Stage

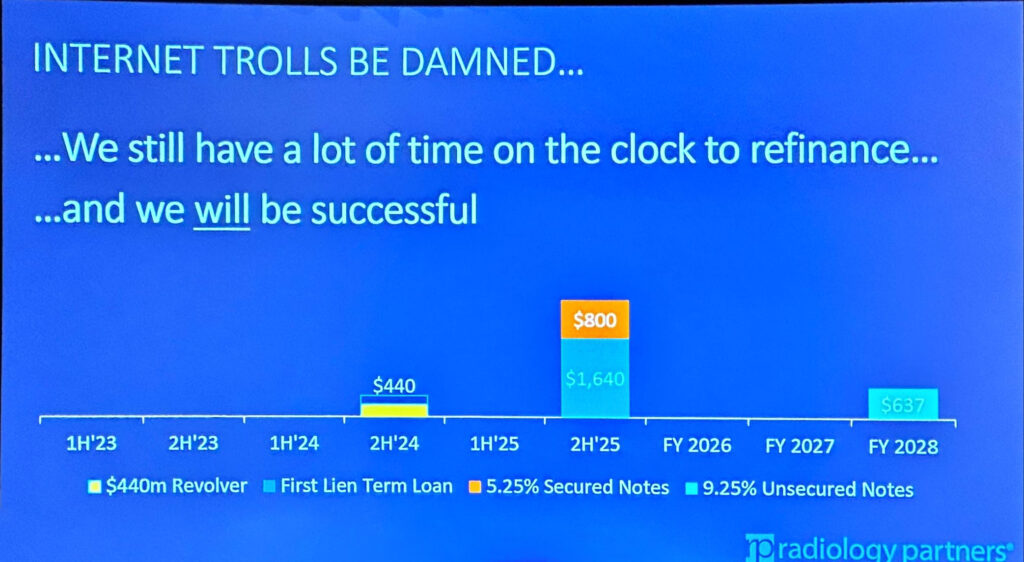

Going into 2024, RP was already cashflow negative (i.e. losing money) to say nothing of the massive debt payments due this year and next. For a reminder of what was coming, recall this slide:

But it’s more than that: In addition to having no ability to pay these loans back, RP told lenders they’re a month or two away from running out of money period. They’ve been trying to raise equity (i.e. sell a stake in the company) to pay off some of the debt including a big effort last summer, but even their own materials assume the need to refinance. (No big surprise there, it’s common practice in this high-leverage industry.)

However, there’s a chicken and egg problem. Recall that in a bankruptcy, debtholders get paid before equity holders get a dime. No one wants to put fresh money into a failing business about to go bankrupt, so no one in their right mind would invest if the current debtholders weren’t willing to “amend and extend.” But debtholders aren’t going to A&E unless they think their odds of getting money back are improved by pushing back the due date. They want to see a really healthy business or at least fresh capital coming in to keep things afloat.

The Debt Part of the Deal

RP Reports:

-

Revolving credit facility lenders have agreed to extend the maturity from late 2024 to 2028 and amend certain terms thereof.

-

First Lien Term Loan lenders have agreed to extend the maturity from 2025 to 2029 and amend certain terms thereof.

-

RP is offering to exchange its senior secured notes due in 2025 for new first lien notes due in 2029 and its senior unsecured notes due in 2028 for new second lien notes due in 2030.

So RP has gotten the majority of their lenders to refinance their loans, pushing back the maturity dates further into the future in exchange for a higher interest rate. (As of the announcement, they were actually still just shy of their target percentage needed to make the math work.)

On top of that, it sounds like most of the payments in the near term are going to be Payment in Kind (PIK) (extra debt instead of cash), which further illustrates how tight cash is right now.

The “Preferred” Equity Part of the Deal

RP Reports:

-

“RP also expects to raise new equity concurrent with the closing of the refinancing transactions.”

What RP is burying in this press release (but what Radiology Business reported on) is that they are trying to raise $300 million in preferred equity.

What does that preferred equity mean for current equity owners, particularly those radiologists holding common stock?

The radiologists lose and continue to lose in this scenario.

In a bankruptcy, preferred equity has to be made whole before common equity gets anything. With $300 million more preferred equity leapfrogging them in the lunch line, the value of most radiologists’ stock continues to trend to zero. This new investment will get paid first if RP gets liquidated in the future or ends up in the hands of its creditors (like what happened to behemoth Envision last year).

Second, this preferred equity will also be paid in kind. As in, instead of receiving cash dividends, they’ll regularly be receiving a large percentage of their investment as additional shares of stock instead. Every year, they’ll own more of the company.

(On the other hand, in fairness, this deal theoretically gives them time to find a buyer one day that will actually give some docs a payout of something for their shares. I doubt it, but being closer to the front of a buffet line with no food doesn’t do you any good.)

To summarize:

If RP one day goes bankrupt, in the event the equity holders get anything, then this new investment will be part of the group (mostly held by large institutional investors) that actually gets some of their investment back. Most of the radiologists will get nothing.

If RP one day becomes a self-sustaining successful company, then many of those radiologists who think they own a sizable share of the company will instead have an ever-decreasing fraction over time. The longer RP exists, the more physician stockholders will be diluted.

Radiologists have long thought and been promised that they are real partners in Radiology Partners. They are not.

A Done Deal?

RP has been telling lenders that they have a firm equity commitment in order to convince them to refinance. They need essentially everyone on to refinance. (As in: if everyone we owe money to doesn’t amend & extend, the house of cards will fall, and all of you will get peanuts–so better get on board.)

How much of that $300 million is really ready to go? Reportedly, $100MM is from the existing sponsors, $100MM from some of their tagalong Limited Partners, and $100MM from a “family office in the Middle East” that is very much pending. It’s hard to get outside investment in this scenario if the existing owners aren’t putting up some more money to keep their skin in the game.

That last $100MM is much more dubious. Ultimately, it’s not possible to put a likelihood on that coming through or whether RP has plans to go out after the refinancing is done and use that good news to try and raise some more capital.

RP is presenting a confident front and touting everything like it’s all a done deal. It’s not. They need everyone to do as they’re told and some people to make a $100MM investment who aren’t actually approved right now to do so. But lest anyone think I’m just being a naysayer, I suspect despite that they’ll probably get the stragglers on board, and the slide from last year will prove true: they will refinance.

They aren’t too big to fail, but they’re certainly too big to fail easily.

Distressed Vibes

Update 1/26/2024: Yes, S&P has indeed called the planned exchange distressed, has lowered the rating on RP’s unsecured notes, and expects to lower RP’s credit rating to ‘SD’ for “selective default.” They’ll refresh the ratings when the transaction closes. If the terms are worse than they’re guessing, they’ll lower to ‘D’ for default, their lowest rating.

The rating agencies will likely call this a distressed exchange (considered a bankruptcy equivalent). These transactions look different when the agencies know that a Caa-rated company can’t service its debt and is pulling things together at the last second through equity financing and strong-arming its debtholders. Here’s some more reading on distressed exchanges. From that article:

Moody’s explains that often, the rating of the issuer is the determining factor of whether or not it is opportunistic. Debt exchanges from issuers rated B1 and higher are typically deemed as opportunistic refinancing vs. those rated Caa1 being viewed as distressed exchanges.

Also note that in addition to the proposed refinancing for the revolving credit line and first lien holders, RP is “offering to exchange its senior secured notes due in 2025 for new first lien notes due in 2029 and its senior unsecured notes due in 2028 for new second lien notes due in 2030.” A debtholder taking a haircut on principal (which we should assume is part of the offer) in exchange for moving up on the payment ladder is another characteristic feature of a distressed exchange.

So, while the RP press release treats this like it’s the victory of their dreams, it’s ultimately just a bankruptcy equivalent: a mission-critical exchange for a company on the verge of collapse that debtholders accept because they have to–not because they want to–and that keeps the company afloat by trading an ownership stake (preferred equity) to pay off a tiny fraction of its debts and get enough cash on hand to keep the lights on for a few more months.

Promises of Future Tripled Earnings

In the working of this comprehensive plan, Radiology Partners has continued to spin a fanciful narrative regarding its future prospects as a company. They are telling folks that they intend to more than triple their earnings over the next four years. Triple!

In the face of a big labor shortage, do they sincerely believe that they have that many more subsidies to wring from their hospital contracts or that their AI capabilities are going to more than double productivity over the next couple of years?

I don’t buy it and don’t think that the debtholders do either. This refinancing isn’t an endorsement of the business but rather the simple realization that 1) RP will default on their first loan payment in February if everybody doesn’t play ball and 2) it’s better right now to keep this company afloat and hope that a future interest rate environment makes refinancing better/more doable than let it implode and potentially getting nothing. This is the reality of business.

The company has taken on enough investment and borrowed enough money that many third parties have a vested interest in it succeeding, even if they currently are dubious about its actual health and success as an entity.

At this point, RP needs to keep its groups afloat, fix its cash flow problems including reimbursement delays (and United), and reduce its burn rate, all while also making much more progress on its technological stack development: either to make its clinical labor more profitable and/or to pivot more into AI and take advantage of the current bubble.

Personally, I strongly suspect that this new preferred equity is probably coming on board due to promises of future AI glory and not based on RP’s more tenuous maturing physician workforce in an overall decreasing reimbursement environment.

While I’m not saying RP’s previous investment in AI is vaporware, I’d be pretty surprised if they’re keeping anything so uniquely game-changing (triple earnings!) so close to their chest. And unless they know something about precipitous legislative changes about the scope of mid-levels in radiology, I simply don’t see how any radiology practice in the country, let alone RP, would be able to triple earnings in this relatively low-margin business over such a short time horizon given the current pace of development.

Liquidity & Leverage

Ultimately, RP’s high degree of leverage isn’t going away. Refinancing means delayed maturity dates and increased interest rates (aka kicking the can down the road). These loans will cost more money, not less, and there is still no real long-term plan that makes this degree of leverage serviceable over time. Can RP just pay the minimum and refinance in perpetuity? Sure, that’s the hope. The rate environment right now is unfavorable and they were still able to bully their current lenders. No one can predict what rates will be in the future, but it may be much easier next time if they can keep from capsizing. After all, when the enterprise first started, borrowing money was essentially free.

For years now, RP has been saying that it’s successful on a cash basis but just needed to deal with its outstanding debt/leverage. Now, the immediate debt crisis will be solved, but they aren’t healthy from a liquidity perspective. The new equity they have coming in will buy them a little time but doesn’t solve their cash flow problem.

Publicly, that’s not part of their narrative: they are, for example, arguing they’ll be seeing ~150MM from UnitedHealthcare coming in Q2 that very well may not materialize. And they still need that money. They are also maintaining that they haven’t lost physicians, which is both untrue in the past but will also remain untrue over the coming year as multiple groups hit the end of their 5-year vesting/contracts.

In Summary

We’ve gone from good liquidity but too much debt to freshly deferred debt and not enough cash. Without this deal, they are a mere month or two away from running out of cash. Yes, payroll is that tenuous. But assuming the rest of the “comprehensive set of financing transactions” finalize over the coming weeks, RP will have successfully sold out their radiologists and bought themselves a runway to fight the good fight of being “the leading radiology practice in the U.S.”

(On a related note, I’ve been getting more PE and RP-related hate mail/comments recently. If anyone in RP leadership would like to weigh in on this or any other article, particularly for any perceived factual inaccuracy, I’m always happy to talk.)

10 Comments

Have you considered why there’s new third party money coming in? People who have no vested interest in the structure are putting in fresh capital. It would be an interesting exercise to understand who they are and why and what do those guys see.

But no, let’s beat the same old tired drum, and lean further on a narrative one has built for oneself and conforting confirmation bias.

That’s in the article, if you read it. I know it’s long.

I have a thought. Institutional money is not as smart as we think and there is still more dry powder looking for deployment than most think. So yes new investment may come in on significantly better terms than old $$$ did. They also didn’t retire the debt, rather deferred it. So the payback still has to happen but where is the increased earnings coming from. Radiologist job market is tight for next 5 yrs minimum. Plenty of practices are taking contracts away from RP

“Institutional money is not as smart as we think“

Sure… people who were offered 100x more information via NDAs vs what’s available publicly looked at it and came to a certain conclusion, so a read would be that they know a hell of a lot more than you vs concluding they must be wrong / they’re stupid. This is example of preconceived conclusions and existing biases.

This is what bothers me about this whole discussion—this stubborn intellectually bankrupt pride in one’s ignorance vs any element of curiosity in understanding what one might be missing. Easier to just tilt at windmills.

I’ll add a few words here for readers seeing the dueling anonymous internet commenters.

1) I do consult with knowledgeable financial professionals and other radiologists when I write these posts. I’m not that precious with my perspective on events that I’m not red-teaming my arguments and conclusions. The majority of this and most of my RP coverage is what’s happened, what is happening, and enough context to make sense of it for those who are interested–not just what I think will happen. I don’t make many predictions in general, and I also wouldn’t put much stock in mine. If RP were a publicly traded company, I wouldn’t invest in it nor short-sell it.

2) Since we’re discussing bias. More information isn’t always better. Kahneman has called overconfidence “the most significant of cognitive biases.” There’s a great chapter (“Chapter 5: Do You Really Need More Information?”) in Richards Heuer’s classic CIA manual on decision-making Psychology of Intelligence Analysis. His summary:

I am a fallible human being, and so is everyone else. Neither I nor anyone else reading this has a monopoly on confirmation bias or the sunk cost fallacy.

3) RP’s money drama here is following the bankruptcies of Envision and Akumin. Snarky comments aside, we’re way past the point of internet bystanders just taking potshots because of wishful thinking. These are big companies, and their struggles are real.

720 million eggs

Indeed!